Regulation A+ has emerged as a prominent mechanism in the world of capital raising, enabling companies to raise funds from a broader pool of investors through crowdfunding. Supporters tout its potential to democratize access to investment opportunities and fuel innovation by connecting businesses with everyday individuals. However, some skeptics argue that the hype surrounding Regulation A+ may inflate its benefits and pose inherent risks for both companies and investors.

- Furthermore, the success of a Regulation A+ offering depends heavily on factors such as the company's history, market conditions, and the skillfulness of its marketing and investor relations efforts.

- Understanding the regulatory framework surrounding Regulation A+ can also be complex for companies, requiring considerable legal and financial expertise.

Ultimately, whether Regulation A+ lives up to the expectations or remains simply a fleeting trend is a question that will become clear in the coming years as the environment of capital raising continues to evolve.

Regulation A Plus

MOFO is devoted to offering comprehensive legal guidance for companies exploring Regulation A+. This unique financing mechanism can empower businesses to raise capital from the public, opening new opportunities for growth and expansion. Our team of seasoned attorneys holds in-depth knowledge of the nuances of Regulation A+ and is committed to assisting clients through every stage of the journey, from initial planning to final filing.

Whether you are a startup seeking to introduce your next project or an established company aiming for to raise capital, MOFO's Regulation A+ team is here to provide the assistance you need to thrive.

Dive into Title IV Regulation A+ for me | Manhattan Street Capital

Title IV Regulation A+, also known as Reg A+, is a section of U.S. securities law that permits companies to raise capital from the public withoutcompleting an initial public offering (IPO). This regulation offers a efficient route for smaller companies to access capital. Manhattan Street Capital is a leading website that focuses on Reg A+ offerings, bringing together companies with investors.

Understand how Reg A+ works, its pros, and the process involved in a successful offering. Manhattan Street Capital's professionals provide support to both companies and investors throughout the Reg A+ journey.

Revolutionizing Capital Raising: New Reg A+ Solution

The landscape of capital raising is changing rapidly, and a new solution is emerging to empower businesses to attain the funding they need. Regulation A+, or Reg A+, offers a unique opportunity for companies to raise considerable capital from the public market while maintaining greater flexibility. This innovative approach allows businesses to bypass traditional venture funding models and directly connect with a wider range of investors.

- Leveraging the power of Reg A+ can provide numerous advantages for businesses, including:

- Increased brand visibility and awareness

- Efficient fundraising process

- Connection to a broader pool of investors

- Capital for growth and expansion

With its promise to democratize capital access, Reg A+ is poised to become a game-changer in the world of finance. Businesses seeking innovative funding solutions should carefully consider this emerging phenomenon.

What Is A Reg - We Have All Of Them

Alright, listen up! Let's/Here's/Time To Talk About the lowdown on regs. They/These things/Those pesky rules are everywhere, man. In every/all/some corner of the world/your life/this crazy game. We're talking about all kinds/every single type/the whole spectrum - you name it, we got it. Regulations/Laws/Rules and Regulations for everything from/like/from A to Z, and then some! Don't even try to dodge/skirt around/avoid 'em, they're the backbone/foundation/unspoken force of how things run.

- Stay in the loop

- Get savvy

So get ready to dive into/Learn all about/Uncover the amazing/complex/intricate world of regs! You won't regret it.

{Unlocking Growth|{Accessing Capital|Navigating Funding : What Startups Need to Know About Regulation A+

Regulation A+ presents a unique opportunity for startups seeking funds to their business. This financing vehicle allows companies offer securities nationwide, potentially reaching a wider investor base. Grasping the nuances of Regulation A+ is {crucial|vital for startups aiming to harness this mechanism.

A key component of Regulation A+ is its flexibility. Startups can choose different offering structures and establish the amount they seek. {Furthermore,|{Moreover,|Additionally, Regulation A+ offers efficient compliance requirements compared to other public offerings.

This funding route can provide startups with a legitimate channel for {securing capital{, enabling them to fuel growth.

How Regulation A+ Works with Equity Crowdfunding

Regulation A+, a capital regulation in the United States, presents an intriguing mechanism for companies seeking to raise capital through investment crowdfunding. It permits firms to distribute securities to the public without adhering to the stringent requirements of traditional IPOs.

Under Regulation A+, businesses can solicit up to $75 million from both accredited and non-accredited investors over a determined period. This structure empowers smaller companies to access a broader pool of capital, fostering development across various sectors.

A key distinction between Regulation A+ and other crowdfunding models lies in Andy Altahawi the nature of investments offered. Investors in a Regulation A+ offering receive equity, meaning they become partial owners of the company. This format provides investors with the potential for financial return based on the success of the company.

The process typically involves filing a registration statement with the Securities and Exchange Commission (SEC) and meeting certain transparency requirements. Moreover, companies must comply with ongoing legal obligations.

Regulation A+ FundAthena

FundAthena has a novel approach to fundraising through an innovative Regulation A+ process. This methodology facilitates companies to attract considerable capital through the broader investment community.

FundAthena's knowledge in the Regulation A+ structure promotes a efficient fundraising experience for companies. Their dedicated team provides full-service support throughout every stage of the offering.

FundAthena's achievements in the Regulation A+ space demonstrate their capability to navigate companies toward investment.

A shell corporation

A blank-check is a type of entity that goes public through an stock market debut. Unlike traditional IPOs, which target particular industries, blank-check companies lack a concrete operational strategy at the time of their formation. Instead, they take over an target company within a defined period, usually sixteen months.

The acquired company then merges with the SPAC's structure. This transaction allows private companies to access public capital markets more efficiently.

Early Colonial Securities

The early/initial/foundational era/period/age of colonial stock securities/investments/holdings was a unique/novel/unfamiliar phenomena/occurrence/event. Driven by expansion/exploration/trade, colonial companies/enterprises/firms issued shares/stock certificates/instruments to fund/finance/provide capital for projects/ventures/operations such as plantations/shipping routes/mines. These securities/assets/holdings were often traded/exchanged/moved in a decentralized/informal/unregulated manner/fashion/system, with prices/valuations/estimates fluctuating based on supply and demand/market conditions/local factors. Despite/While/Although these early/initial/foundational forms of stock securities/investments/holdings were limited/restricted/confined in scope, they laid the groundwork/foundation/basis for the development/evolution/advancement of modern stock markets/financial systems/capitalism.

Look What We Discovered

We managed/were able to/succeeded in get our hands on/find/locate a cool new/rare/unusual registration. It's a real gem/unique find/fantastic piece of history.

This is the best thing since sliced bread, and we can't wait to/are excited to/looking forward to share it with you all/show off our find/tell everyone about it.

Stay tuned for more updates!

Explore Your Funding Potential with Title IV Reg A+ | Crowdfunder Blog

Are you an entrepreneur with a revolutionary idea seeking to secure funding? The world of crowdfunding has opened up incredible opportunities for businesses like yours. In this insightful infographic, we delve into the effective realm of Title IV Reg A+, a unique funding strategy that can propel your venture to new heights. Discover how Reg A+ empowers you to attract investors and accelerate your business growth.

- Explore the key benefits of Title IV Reg A+.

- Grasp the process of a successful Reg A+ campaign.

- Learn from real-world examples of companies that have utilized Reg A+ for funding.

Don't miss out on this valuable resource to unlock the potential of Title IV Reg A+ and transform your business journey.

Funding Round - Securex Filings LLC

Securex Filings LLC recently to leverage Regulation A+ to raise investment for growing its {operational{ capacity. This regulatory framework permits companies to sell securities to the general public, thereby creating a alternative pathway to acquisition.

As this framework, Securex Filings LLC aims to engage backers who are interested in its vision.

- Moreover, Regulation A+ offers transparency to participants by requiring thorough reports about the company's operations.

- Through this method, Securex Filings LLC seeks to bolster its strategic position and fuel future development.

Explore Crowdfunding Opportunities at Crowdfund.co through

Crowdfund.co is a platform that brings together businesses and individuals who are looking to fund their projects. Whether you're an entrepreneur with a groundbreaking idea or someone who wants to support innovative endeavors, Crowdfund.co provides a thriving space for collaboration. With a wide range of projects encompassing various industries and causes, you're sure to locate something that interests with your beliefs.

- Begin your own crowdfunding campaign and reach a broad audience of potential supporters.

- Discover a curated selection of projects that are changing the world

- Interact with like-minded individuals and forge connections

Fundrise's Reg A+ Offering

Fundrise is a well-established platform providing real estate investment possibilities to individual investors. Their recent Reg A offering, which was launched in late 2024, allows for public participation. This unique structure offers access to a diversified portfolio of real estate assets, typically residential properties, ranging across various locations. Fundrise's Reg A offering is designed to be accessible to investors with modest capital requirements.

- The platform

- Reg A Offering

An Securities and Exchange Commission

The Financial and Exchange Board operates as the primary oversight institution for investments in the United States . Created in 1934, the SEC protects investors, maintains fair and efficient markets, and encourages capital formation. It accomplishes these goals by enforcing federal securities statutes and performing investigations into potential infractions. The SEC's mission is to encourage public trust in the securities industries and protect investors from deceit .

Reg A+ Equity Crowdfunding Platform Powered by CrowdExpert

CrowdExpert provides a comprehensive/robust/advanced platform for businesses/entrepreneurs/startups to leverage Title IV Reg A+ equity crowdfunding/fundraising/investment opportunities. This regulated/legal/compliant method allows companies to raise capital/secure funding/attract investment from the general public/wide investor base/diverse crowd of investors. By utilizing CrowdExpert's platform, companies can/businesses gain access to/firms leverage a vast network/large pool/extensive reach of potential investors/funders/backers while maintaining transparency/accountability/full disclosure throughout the process/campaign/funding round.

- Potential investors can/Individuals looking to invest can/Investors seeking opportunities can readily discover/access/explore promising businesses/ventures/projects and participate in their growth/success/development.

- CrowdExpert streamlines/simplifies/facilitates the process/procedure/entire campaign of Reg A+ equity crowdfunding/fundraising/investment, making it accessible/feasible/attainable for a wider range/broader spectrum/larger number of companies and investors.

- The platform/CrowdExpert's service/This innovative system offers valuable tools/essential resources/comprehensive support to both companies seeking funding/businesses raising capital/entrepreneurs searching for investment, as well as potential investors/individuals looking to invest/backers seeking opportunities.

Trying out the Waters {

Diving into a new venture can be exhilarating and daunting. Before making a full commitment, it's wise to carefully/gradually/slowly test the waters/explore the possibilities/gauge the reaction. This involves taking small steps, gathering information/feedback/insights, and assessing the vibes/climate/atmosphere. By {dipping your toes in/experimenting cautiously/probing subtly, you can determine if it's a good fit/gain valuable experience/avoid potential pitfalls. Remember, it's better to be safe than sorry/knowledge is power/a little caution goes a long way when navigating uncharted territory.

The Power of Mass Crowdfunding

For years, crowdfunding has been/was/is a niche tool/method/resource for startups and creative projects. However, things are changing fast. Platforms are becoming more user-friendly and accessible, while the public is increasingly keen/interested/excited to support causes they believe in. This trend/movement/shift is opening up exciting new possibilities for everyone/individuals/small businesses, allowing them to fundraise/secure financing/raise capital for their dreams without relying on traditional lenders/banks/investors.

- From/With/Through a simple online campaign, you can connect/reach out/engage with thousands of potential backers who are eager to contribute.

- It's/This is/That means no more stuffy board meetings or lengthy applications; crowdfunding empowers individuals/people/anyone to take control/be in charge/steer the ship of their own financial future.

- Whether you're a passionate entrepreneur, a talented artist, or simply have a great idea that needs funding/support/investment, crowdfunding may be the perfect solution for you.

ShareFund

StreetShares is a network that connects small businesses with backers. Founded in 2014, it offers an innovative way to obtain funding for projects. StreetShares leverages a peer-to-peer model, allowing businesses to borrowfunds|access investment|tap into a pool of investors willing to finance their ventures.

By means of its intuitive system, StreetShares streamlines the investment process, making it convenient for both businesses and investors. The organization is focused to empowering small businesses and promoting economic growth.

Fueling Expansion with Regulation A+

Regulation A+, a powerful strategy in the realm of securities offerings, empowers businesses to raise capital efficiently. This innovative structure allows companies to publicly offer their securities to a wider investor base, attracting {capital{from both accredited and non-accredited investors. By leveraging Regulation A+, businesses can propel growth, fund expansion initiatives, and attain their strategic objectives.

The process of conducting a successful Regulation A+ offering involves several key phases:

* Meticulously crafting a convincing offering document that clearly articulates the company's business model, financial projections, and investment needs.

* Engaging experienced legal and financial professionals to guide the process and ensure compliance with all regulatory standards.

* Diligently marketing the offering to potential investors through a variety of channels, including online communities, investor relations events, and targeted campaigns.

Regulation A+ presents a attractive opportunity for businesses seeking to {raise capital{in a open manner. By embracing this innovative tool, companies can unlock growth and position themselves for long-term prosperity.

EquityNet within the SEC

EquityNet is a web-based platform developed by the SEC| The U.S. Securities and Exchange Commission (SEC) that aims to facilitate private market fundraising for small businesses and startups. Companies can utilize EquityNet to connect with potential investors, share information about their investment opportunities, and secure funding through equity offerings. The platform is designed to enhance transparency and adherence within the private capital markets, guaranteeing a secure environment for both companies and investors.

EquityNet offers multiple capabilities to support the fundraising process, including search functionalities, document management, and compliance resources. By centralizing these functions, EquityNet alleviates the complexities associated with private capital raising, making it easier to navigate for businesses seeking funding.

Regulation A+

Regulation A+, often known as Reg A+, is a subset of U.S. securities law that allows companies to raise money by the public sale of their {securities.{ It's a popular substitute for traditional IPOs, particularly for newer businesses.

Companies employing Reg A+ must adhere to certain regulations and the Securities and Exchange Commission (SEC). This framework provides a less burdensome process than traditional IPOs, while still offering investors some level of security.

- Businesses can collect up to $20 million in a 12-month period under Reg A+.

- Investors candirectly invest in

- Enhanced financial information sharing are key aspects of Reg A+ offerings.

Regulation a+ Investopedia

Investopedia's in-depth discussion of regulation a+ delves into the complex world of marketplace rules and their impact on investors. This comprehensive resource provides understanding on key concepts such as regulatory bodies, compliance, and the role of government officials in shaping the trading landscape. Whether you're a seasoned investor or just beginning your investment journey, Investopedia's regulation a+ guide offers valuable information to navigate the intricacies of the regulatory environment.

Companies that are Reg A+

Reg A+ companies are a unique breed of businesses seeking to raise capital. These organizations leverage the Reg A+ framework, allowing them to offer their securities to the public on a more streamlined process compared to traditional IPOs. Unlike private placements, Reg A+ allows companies to raise up to one hundred million dollars from the general public, offering greater transparency.

- As a result, Reg A+ has become increasingly popular among startups and small businesses looking for alternative funding options.

- Furthermore, investors are interested in Reg A+ companies due to the increased liquidity associated with these early-stage businesses.

The Reg A+ landscape is constantly evolving, featuring new regulations and rules emerging frequently.

Governance A+ Summary

The industry of technology/finance/healthcare is undergoing a period of significant evolution. New policies are being implemented to address issues surrounding cybersecurity. These standards aim to ensure the security of networks while also promoting development. Companies must stay informed about these trends and adjust accordingly to avoid fines.

- Important guidelines

- Impact on businesses

- Best practices

Governance in Real Estate

Real estate transactions are a complex industry. To ensure smooth operations, comprehensive rules are in place. These standards aim to safeguard the rights of both buyers and sellers. Accreditation requirements for real estate professionals help maintain a ethical workforce.

Furthermore, laws address issues such as property title, information sharing, and conditions within contracts. These guidelines also influence the development of new buildings.

In essence, regulation in real estate strives to create a equitable and honest marketplace for all parties involved.

Their Mini-IPO First JOBS Act Company Goes Public Via Reg A+ on OTCQX

After months of hard work/dedicated effort/tireless striving, [Company Name] is finally {taking the leap/making its debut/hitting the market]! As a pioneer/trailblazer/visionary in the emerging/dynamic/thriving world of Reg A+ offerings/public markets/capital raising, we're thrilled to announce our successful launch/grand opening/official listing on the OTCQX. This landmark moment represents a huge milestone/significant achievement/major turning point for [Company Name], marking our official entry into the public realm. We're excited/eager/thrilled to share/engage with/connect investors and welcome them on this incredible journey/adventure/pathway as we continue to build/grow/expand our business and create value/deliver success/make a difference.

This is an unprecedented opportunity for both/all/our valued investors to become part of/support/invest in the future of [Company Name] while benefiting from the advantages/opportunities/potential offered by Reg A+. We're confident that this listing will fuel our growth/accelerate our progress/provide us with the resources needed to realize our ambitions/achieve our goals/make a lasting impact.

[Your company name] remains dedicated to its mission of [state your company's mission] and we're grateful/appreciative/thankful for the unwavering support of our investors/community/team. We look forward to a bright future/continued success/unprecedented growth as a publicly traded company.

FundersClub empowers Reg A+ raises on the platform

FundersClub announces a revolutionary update to its marketplace, allowing companies to conduct Reg A+ investment drives. This expansion expands doors for businesses seeking to raise investment from a wider pool of backers through the streamlined process offered by Reg A+.

- {Companies|Businesses can now leverage FundersClub's established network and expertise to run successful Reg A+ offerings.

- FundersClub provides comprehensive guidance throughout the Reg A+ process, from compliance and documentation to investor engagement.

- Investors can participate in promising companies' growth by investing in Reg A+ offerings through the FundersClub platform.

This development signifies FundersClub's commitment to empower access to capital and promote innovation in the entrepreneurial ecosystem.

Securities Regulation: What is Reg A+

Regulation A+, often known as Reg A+, is a provision of the United States securities law that allows companies to raise capital from the public through an less traditional offering process. Unlike conventional IPOs, Reg A+ offerings have substantially simplified requirements for reporting. Companies can offer their stocks to the public on a national basis, perhaps reaching a wider investor pool.

Reg A+ offers several advantages over other fundraising methods. These include a simplified registration process, reduced costs, and the ability to attract a diverse group of investors. However, it's important to note that Reg A+ maintains certain disclosure obligations and companies seeking to utilize this legal avenue should consult with legal and financial professionals for advice.

- The core components of Reg A+ involve:

- {Tier 1 offerings, which allow for up to $75 million in capital raised per year. | Tier 1 offerings, permitting a maximum of $75 million in capital raised annually.| Tier 1 offerings enable companies to raise up to $50 million per year.

- {Tier 2 offerings, which permit larger amounts of capital to be raised. | Tier 2 offerings, allowing for a greater volume of capital raised.| Tier 2 offerings facilitate the raising of substantial capital.

Scrutinize + Crowdfunding Platforms

Crowdfunding platforms have revolutionized the investment landscape, providing an alternative avenue for individuals and startups to secure resources. However, as these platforms expand, it becomes crucial to establish a robust regulatory framework. This framework should aim to balance the need for investor protection with the encouragement of innovation and entrepreneurial activity.

One key dimension of regulation should focus on accountability. Crowdfunding platforms should be required to provide investors with clear and concise information about the projects they are funding, including projections. Additionally, platforms should implement stringent KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures to minimize the risk of fraud and illicit activity.

Additionally, regulation could resolve issues related to consumer safeguards. This might involve creating a fund for investors who suffer losses due to platform misconduct or deceptive practices.

A well-designed regulatory framework for crowdfunding platforms can promote a more responsible ecosystem, benefiting both investors and entrepreneurs alike.

Supervision + IPO

Navigating the intricate landscape of a governed initial public offering (IPO) requires meticulous planning and expert guidance. The process involves stringent compliance with securities laws and regulations, ensuring transparency and investor assurance. Companies must display robust internal controls to reduce potential concerns and build trust with the public community.

Regulation A+ Offerings

A+ offerings are subject to stringent guidelines. These rules are designed to ensure investor protection and maintain market fairness. Supervisory bodies often mandate certain disclosures for A+ offerings to keep investors educated about the risks involved.

Compliance with these regulations is essential for companies offering A+ securities and helps build investor confidence.

- Supervisory bodies play a key role in monitoring A+ offerings to ensure compliance with established guidelines.

- A+ offerings are often subject to higher scrutiny than other types of investments.

Governance A+ Rules

When implementing A+ standards, it's vital to ensure clear and thorough regulation. These rules should effectively address potential concerns and provide a framework for successful execution. A+ policies must be adaptable to evolve with the evolving environment of your industry.

- Key aspects of A+ regulation include:

- Openness: Rules should be easily interpretable to all parties involved.

- Responsibility: Clear lines of duty must be defined.

- Implementation: Effective mechanisms for monitoring compliance are crucial.

Solicitation Requirements Regulation

The realm of investment markets necessitates stringent guidelines governing the procedure of solicitation securities to interested investors. These standards are designed to ensure transparency and defend investors from deceptive behaviors. A comprehensive understanding of these rules is essential for both issuers seeking to raise capital and buyers assessing investment ventures.

- Fundamental among these requirements are the disclosure obligations placed on entities. They are required to submit buyers with extensive and precise knowledge regarding the scope of their activities, monetary results, and perils associated with the investment.

- Additionally, regulations often define ceilings on the sum of securities that can be sold and may levy registration criteria on all entities and brokers involved in the offering procedure.

- Additionally, regulations frequently cover the actions of market participants to mitigate misrepresentation and ensure a fair market.

Exploring Regulation in Crowdfunding

{Crowdfunding, a platform for raising capital directly from the public, has experienced a surge in recent years. However, its dynamic nature presents unique challenges when it comes to regulation. Governments worldwide are actively working to establish robust regulatory frameworks that harmonize the benefits of crowdfunding while mitigating potential risks for investors and businesses.

- Crucial components of crowdfunding regulation often include investor safeguards, platform transparency, and benchmarks for fundraising campaigns.

- Authorities are continuously using a multifaceted approach to regulation, encompassing licensing requirements, disclosure obligations, and oversight mechanisms.

- Complying with the evolving regulatory landscape in crowdfunding requires both businesses and investors to stay updated about relevant regulations.

{Furthermore, the global nature of crowdfunding necessitates international collaboration among regulators to ensure a unified approach to oversight. As crowdfunding continues to evolve, regulation will play an essential role in fostering a fair and sustainable ecosystem for all participants.

Showcase your expertise

SlideShare is a popular platform for sharing slides online. It's a valuable tool for businesses to engage with their community. With SlideShare, you can develop visually appealing reports that are easy to share. Audiences can browse a wide range of topics and learn valuable knowledge. SlideShare also features tools for tracking the performance of your content. Whether you want to inform, SlideShare is a platform to consider.

Provisions a Securities Act of 1933 Jobs Act 106

The Securities Act of 1933 is crucial piece of legislation that sets the framework for the issuance and sale of securities in the United States. The Jobs Act of 2012, specifically Section 106, modifies certain provisions of the Securities Act to streamline the acquisition of capital by small businesses and promote economic growth. This amendment has been debated for its potential impact on investor protection and market integrity.

- Key changes brought about by Section 106 include:

- Relaxing disclosure requirements for certain offerings of securities.

- Offering exemptions from registration requirements for some small businesses.

- Creating new rules for the crowdfunding of capital.

A Second-Tier Service

A Tier 2 offering generally delivers a more comprehensive range of features compared to its Tier 1 counterpart. While it may not encompass the full spectrum of options found in higher tiers, it provides meaningful value for users who require advanced functionality without the price premium associated with top-tier solutions.

Tier 2 offerings are often appropriate for users seeking balanced performance. They strike a calculated balance between cost and features, making them appealing choices for a wide user base.

Controlling a Written Work

Effectively managing a text document is crucial for maintaining consistency. This process involves applying clear rules to dictate the structure and information of the text. Moreover, it can comprise tools for verifying the authorship of the text and detecting potential anomalies.

- Several typical methods for regulating text comprise proofreading, analyzing, and evaluation.

Finally, the goal of managing a text is to create a clear and reliable product.

Governance A+ Offering

A oversight A+ offering signifies a stringent framework that facilitates the highest standards of compliance. This type of offering often involves thorough procedures and strategies to reduce vulnerabilities, fostering a reliable environment. Organizations that adopt a regulation A+ offering can strengthen their reputation within the industry and gain the confidence of stakeholders.

Control A Plus

In the dynamic landscape of modern/contemporary/today's business, it's essential to navigate a complex web of rules/guidelines/standards. A proactive approach to compliance/adherence/observance can be the key to unlocking success. "Regulation A Plus" offers a unique/novel/innovative framework that empowers businesses to thrive/prosper/succeed within a regulated/controlled/governed environment.

- Streamlining the funding process for small and medium-sized enterprises (SMEs) is a primary goal of Regulation A Plus.

- By providing clarity/transparency/guidance on reporting requirements, it helps build investor confidence/trust/assurance.

- Increasing access to capital for businesses can fuel innovation and economic growth.

Regulation A Plus isn't just about fulfilling/meeting/satisfying regulatory obligations; it's about creating a level/fair/balanced playing field that promotes/encourages/supports responsible business practices.

Regulation A vs Rule D

When it comes to raising capital, businesses often turn to investment rules. Two common pathways are Regulation A and Regulation D, each with distinct conditions. {Regulation A allows companies to raise funds from the general public through offerings of up to $5 million or $75 million while Regulation D focuses on private placements limited to a select group of participants. Regulating A, also known as "Mini-IPO," involves a greater level of public transparency compared to Reg D, which prioritizes confidentiality. Businesses should carefully evaluate their aspirations and situation when choosing the most suitable regulation for their capital raising needs.

- Regulation A provides a streamlined process

- Regulation D offers greater control over investors

FRB Regulation A Guidelines

FRB Regulation A encompasses a range of mandatory stipulations implemented by the central bank to ensure the soundness of the financial system . These policies aim to mitigate systemic risks and foster openness within the banking institutions . FRB Regulation A often involves monitoring of financial activities , as well as risk-based capital standards to safeguard financial resources.

The framework outlined by FRB Regulation A is subject to change to adapt to financial innovations. This ever-changing terrain requires banks to remain compliant with the latest pronouncements.

Approves New “Reg A+” Rules for Crowdfunding

The Securities and Exchange Commission (SEC) has recently offered the green light to new rules under Regulation A+, a popular avenue for small businesses to raise funds through crowdfunding. These updated guidelines aim to enhance the process, making it less accessible for companies to secure investments from the mass market.

With this legal shift, the SEC hopes to encourage economic growth by promoting access to capital for growing enterprises. The new rules are expected to bring about a noticeable impact on the crowdfunding landscape, enabling companies to partner with a wider range of investors.

Securities Regulations

When exploring the realm of capital funding, understanding the differences between Regulation A+ and Regulation D is crucial. Both offer options for enterprises to obtain funding, but they distinguish in terms of scope, investor participation, and reporting needs. Regulation A+ is a tiered system that allows for public offerings, attracting a broader pool of investors. In contrast, Regulation D emphasizes on private placements, limiting investor participation to accredited investors only.

- Comprehending these rules can be complex, so it's recommended to consult with a financial professional for direction.

Regulation D's Rule 506

Rule 506 of Regulation D outlines specific parameters for private placements under the Securities Act of 1934. This provision allows companies to raise capital by selling securities to a limited amount of accredited investors and/or unaccredited investors who meet certain standards. Rule 506 generally has two variations: Rule 506(b) and Rule 506(c). Rule 506(b) permits offerings to a limited number of investors, but requires full revealing of all material facts. On the other hand, Rule 506(c) limits the number of investors to fewer than 210, while allowing for restricted disclosure requirements.

- Furthermore, Rule 506 compliance involves several duties such as investor authentication and the maintenance of comprehensive documentation.

- Keep in mind that seeking legal counsel from experienced securities lawyers is highly suggested when navigating the complexities of Rule 506.

Standard 506C

The frequently used method for evaluating a software system's ability to handle difficult tasks is known as assessment 506C. This in-depth process involves carefully examining the program's performance under multiple situations.

- Experts employ 506C to identify possible flaws that might develop during normal operation.{

- The objective of 506C is to ensure the application's robustness and compliance for its designated user base.

Furthermore, 506C helps programmers to enhance the program's efficiency and ease of use.{

A Primer into 506D Regulations

506D of the Federal Register outlines comprehensive rules governing private placements. It mainly focuses on revealing crucial facts to purchasers before they invest. Adhering to 506D is essential for avoiding legal trouble. Grasp of these regulations can protect both issuers and investors.

Regulation D - Rule 506(b) vs. Rule 506(c) Regulation D - Rule 506(b) versus Rule 506(c) | Regulation D: Rule 506(b) Versus Rule 506(c)

When launching into the realm of private securities offerings, understanding the nuances of Regulation D is paramount. Within this framework, Rules 506(b) and 506(c) provide distinct avenues for companies to raise capital from accredited investors. Rule 506(b) utilizes a more conventional approach, relying on private placements made through individual solicitation and requiring all purchasers to be verified. Conversely, Rule 500(c) introduces greater flexibility, permitting general promotion through internet or other media channels. However, this broader reach comes with the requirement of conducting due diligence to confirm the accredited status of all participants.

- Choosing the appropriate Rule depends on a company's situations, including its capital goals, target market, and familiarity with regulations. By meticulously evaluating these factors, companies can strategically leverage the benefits of each Rule to effectively execute their fundraising endeavors.

Conquering Series 7 Regulations: A Cheat Sheet

The Series 7 exam is a/represents/serves as the gateway to becoming a licensed securities representative in the United States. To successfully ace/pass/conquer this rigorous/challenging/demanding exam, you'll need to grasp/understand/internalize the intricacies of securities regulations. This cheat sheet provides a quick/helpful/essential overview of key Series 7 regulations, helping/aiding/guiding you on your journey to success.

- Know/Familiarize yourself with/Be proficient in FINRA's role as the regulator/governing body/authority over securities markets.

- Understand/Comprehend/Learn the different types of securities, including stocks, bonds, and mutual funds.

- Stay informed about/Be aware of/Familiarize yourself with regulations related to trading practices, such as/including/like market manipulation and insider trading.

- Remember/Keep in mind/Note the importance/significance/relevance of client confidentiality and fiduciary duty.

By studying/reviewing/familiarizing yourself with these key regulations, you'll be well-prepared/have a strong foundation/set yourself up for success on the Series 7 exam. Remember to consult/refer to/utilize additional resources and practice tests/sample exams/study materials to enhance your understanding.

Utilizing DreamFunded Resources on Regulation A+

Navigating the nuances of Regulation A+ can be a formidable task for companies. However, DreamFunded offers a treasure trove of indispensable resources to help you efficiently comply with the regulations and raise capital. Their comprehensive platform provides individuals with critical information about Regulation A+ projects, including vetting tools, industry insights, and legal counsel. By harnessing DreamFunded's guidance, you can expedite the process of securing funding through Regulation A+.

- Gain a profound knowledge of Regulation A+ requirements.

- Connect with capital providers.

- Access industry-leading platforms to handle your investment campaign.

Alternative Trading Systems

Trading securities on OTC Markets can present both risks. Investors seeking to access companies not listed on major stock markets may turn to OTC Markets. However, it's crucial for investors to comprehend the unique characteristics of this trading environment. The lack of stringent controls and the potential for volatility are key factors to evaluate when participating in OTC Markets.

- Before investing on OTC Markets, conduct thorough investigation.

- Review the company's financial statements.

- Be aware the potential for trading volume issues.

Tripoint FINRA

A important aspect of the investment industry is adherence to strict regulations. Within this regulatory framework is the concept of a Tripoint, which illustrates a convergence of governmental bodies responsible for overseeing trading activities. FINRA, renowned as the self-regulatory organization for broker-dealers and registered representatives, plays a central role in this tripartitestructure. The Tripoint FINRA concept highlights the interdependence necessary to maintain a transparent and stable financial market.

An Jumpstart Our Business Startups Jobs Act

The Jumpstart Our Business Startups Jobs Act, often referred to as the JOBS Act, is a/was a/are a landmark piece of legislation that aims to/designed to/intended to revitalize/boost/energize small business funding in/across/throughout the United States. Enacted in 2012, the act made significant changes to/implemented various reforms/introduced sweeping alterations to existing/within/among securities laws in order to/so as to/with the goal of simplify/facilitate/streamline fundraising for startups and small businesses. One of the/most notable/key provisions was/are/were the creation of/for/by new exemptions from/to/under traditional registration requirements, allowing/permitting/enabling companies to raise capital from/attract investment/secure funding more easily/with greater flexibility/in a less cumbersome manner.

The JOBS Act has had/is having/continues to have a profound/significant/substantial impact on/effect upon/influence over the entrepreneurial landscape, by providing/offering/giving startups with a/greater/easier access to capital and helping/enabling/supporting them to grow/expand/thrive.

Acceptance by Regulators

The Tycon SEC approval represents a significant achievement for the company. This essential event paves the way for Tycon to grow its operations and gain further funding. With the regulatory hurdles now removed, Tycon can devote its resources to building its services. This approval is foreseen to stimulate market engagement and solidify Tycon's position as a leader in the industry.

Achieving SEC Qualification towards Investment Firms

SEC qualification is a necessary step for any firm that wishes to operate in the financial markets. It involves a rigorous evaluation of the company's structure, policies, and staff. This system ensures that firms adhere to strict ethical and regulatory norms.

Firms {must{ demonstrate a commitment to investor safety and clarity in their practices. The SEC qualification process can be complex hurdles, requiring firms to {submitto furnish comprehensive reports and participate in a comprehensive assessment. Once a firm has adequately met the criteria, it will be granted an investment advisor certification.

GoFundMe Online donation tools

When you've got a brilliant project and need a little fiscal support, online fundraising tools like Kickstarter, Indiegogo, and GoFundMe become your best friend. These platforms let you showcase your vision with the community and request donations to make it a possibility. From quirky creations to impactful causes, these platforms have assisted countless individuals and groups to bring their ideas to life.

- Several factors influence the success of a fundraiser on these platforms. A persuasive story, excellent visuals, and a transparent goal are vital.

- Engagement with your supporters is also important. Regularly update them on your development, and express your gratitude for their contributions.

In the end, these platforms provide a remarkable chance to interact with a global network and realize your aspirations.

Investment in Equity

Equity investment involves purchasing partial ownership in a company. This typically takes the form of buying shares of stock on the public market or investing directly in a private company through funding rounds.

By acquiring equity, investors become proprietors and have a claim on the company's assets and profits. Equity investments can offer potential for substantial returns through capital appreciation and dividends, but they also carry inherent risks. The value of equity investments can fluctuate significantly based on market conditions, company performance, and other factors.

Potential investors should carefully evaluate their risk tolerance and investment goals before making any equity investments.

EquityNet

EquityNet provides a platform that enables connections between individuals and startups seeking funding. It offers a range of tools and services to streamline the investment process, such as market analysis resources, encrypted communication channels, and vibrant community of users. Through EquityNet, venture capitalists looking for opportunities explore promising projects while entrepreneurs can access capital to fuel their enterprises.

EquityNet strives to

to foster a accessible investment ecosystem that benefits both investors and companies.

EquityNet's impact extends beyond simply bridging parties. It further seeks to empower entrepreneurs by offering access to industry knowledge. By simplifying the investment process, EquityNet contributes to economic growth and innovation.

Venture Goldman Sachs Global Advisors

Goldman Sachs' investment arm has always been strategically involved in the technology ecosystem. Their alliance with Merrill Lynch, a respected financial company, creates a unique ecosystem for funding disruptive businesses. This combination of expertise aims to foster the next generation of trailblazers across a variety of markets.

Raise Capital with Crowdfunder's Reg A+ Offering

Crowdfunder is a leading marketplace for startups to secure capital through its comprehensive crowdfunding solution. Recently, Crowdfunder has been offering Regulation A+ (Reg A+ ) as a efficient tool to help firms access large sums of investment.

- Reg A+ allows non-profit companies to secure up to $75 million from supporters in a more accessible manner.

- Through using Reg A+, companies can expand their operations, launch new services, and attract a wider network.

- Furthermore, Crowdfunder's knowledge in the crowdfunding space ensures companies with a efficient journey.

If you are a entrepreneur seeking to raise capital, Crowdfunder's Reg A+ offering may be the right option for you.

Raising Capital Through Reg A+

When a company needs to raise capital, they often turn to various financial mechanisms. Among these, Regulation A+ (Reg A+) and Regulation A stand out as popular choices for companies seeking to publicly attract capital.

Regulation A+ is a category of securities regulation that allows companies to raise significant amounts of capital from the general public. This approach offers several advantages, such as increased flexibility for shareholders and a wider investor pool.

Regulation A is a more regulated structure that sets concrete requirements for companies attempting to raise capital. It often involves rigorous documentation. Regulation D, on the other hand, focuses on private placements of securities primarily among qualified buyers.

- Firms choosing Regulation A often employ this mechanism to expand their activities and pursue new opportunities.

- Stakeholders attracted by these programs may seek to be part of a growing company's path.

Filing S-1

When a company needs to raise capital through private placements, they often utilize Regulation D under the Securities Act of 1933. This regulation allows companies several exemptions from the typical registration requirements of a public offering. One common method employed under Regulation D is the Form S-1 filing.

Though often associated public offerings, the Form S-1 can also be utilized in private placements under Regulation D. This allows companies to raise capital from accredited investors without going through a full registration process. The details provided in the Form S-1 offers potential investors insight into the company's finances, operations, and future aspirations.

Banking Bank Capital Raise Raise Capital Raising Capital Funding Public Capital Crowdsourced Private Equity Convertible Debt CircleUp Angel List

In today's dynamic financial landscape, startups and established businesses alike are constantly seeking innovative Strategies to raise capital. Traditional Paths, such as bank loans and private equity Investments, remain prevalent, but the rise of alternative Resources has significantly broadened the Horizon. Crowdfunding platforms have empowered entrepreneurs to tap into a vast pool of Investors, while Venture capital firms specialize in providing funding for high-potential ventures. Convertible debt, offered by Institutions like CircleUp and Angel List, provides flexibility and equity participation, making it an attractive Alternative for startups seeking Funding.

Investment Opportunities

The landscape of early-stage capital allocation has witnessed a transformative shift with the rise of digital marketplaces such as SoMoLend. These networks enable venture capitalists to directly invest promising energy companies and entrepreneurs through convertible notes. From early-stage rounds to later-stage investment campaigns, these platforms provide a spectrum of investment options catering to both sophisticated investors and unaccredited investors. MicroVentures and Grow Venture Community are prime examples of these platforms, facilitating non-traditional financing in a way that was previously limited.

GoFundMe, while primarily known for crowdsourcing campaigns, has also extended its reach into the realm of online business funding. This highlights the growing trend of democratizing finance and providing alternative paths for both capital allocators and business owners. With platforms like EquityNet, Startup Engine, and AngelList, the future of venture capital appears increasingly distributed, offering a wealth of opportunities for those seeking to shape the next generation of disruptive technologies.

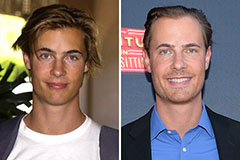

Michael Bower Then & Now!

Michael Bower Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!